japan corporate tax rate 2017

Gold Analysis Twist Could Cause Inflation to. 115-97 replaced the graduated corporate tax structure with a flat 21 corporate tax rate and repealed the corporate alternative minimum tax AMT effective for tax years beginning after December 31 2017.

Japan Household Income Per Capita 2000 2022 Ceic Data

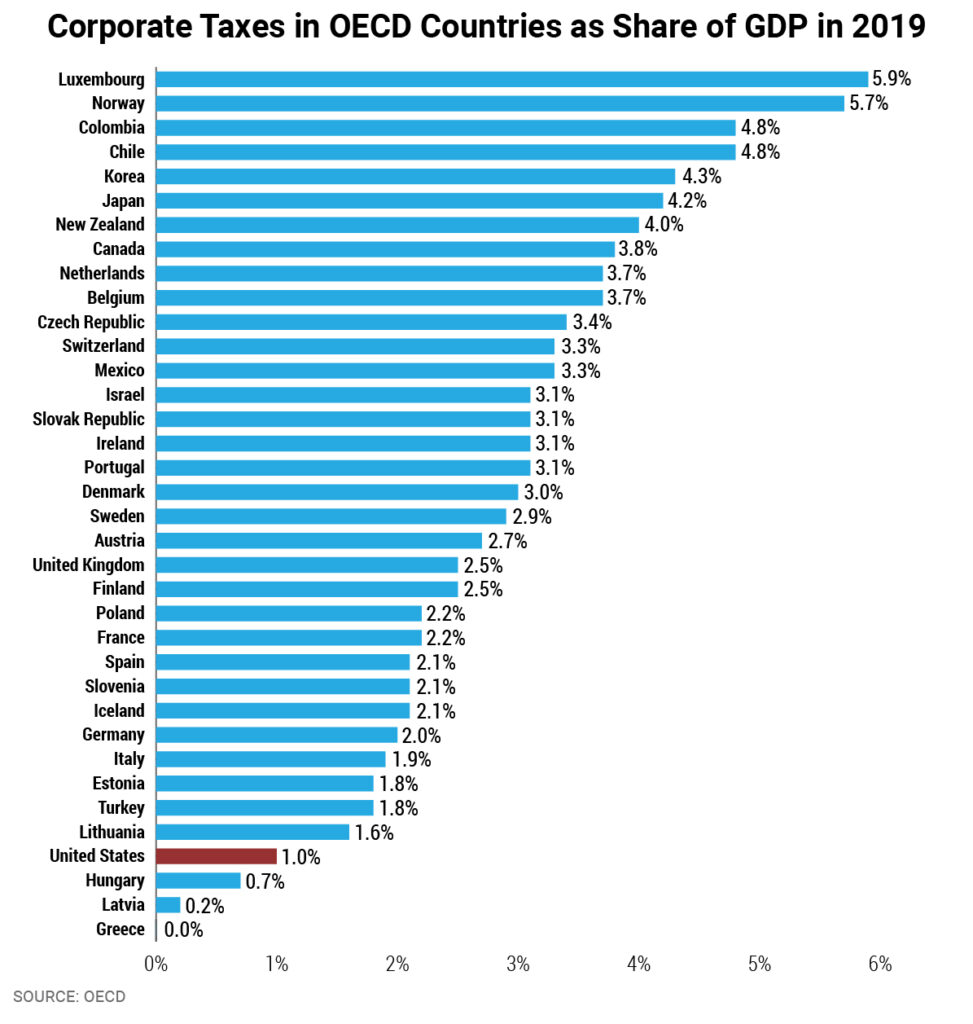

31 Total of GDP 2020 Japan of GDP.

. Corporation tax is payable at 239 percent. Effective Corporate Tax Rates With Uniform and Country-Specific Rates of Inflation in G20 Countries 2012 37 Figure B-4. Paper companies are business entities with no substance like physical assets or employees or without its own administration or management where the head office is.

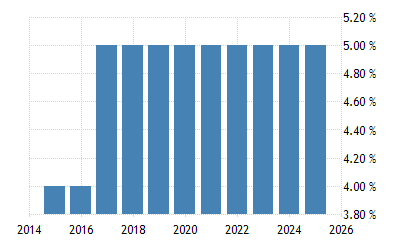

Effective Corporate Tax Rates With Alternative Allocations of Asset Shares in G20 Countries 2012 34 Figure B-2. Increasedecrease Note 2 Tax credit. Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching an all time high of 5240 percent in 1994 and a record low of 3062 percent in 2019.

For large corporations the rate is 148 percent of the prefectural enterprise. Japan Corporate Tax Rate History. The corporate tax rate in Japan for a branch is the same as for a subsidiary.

Local corporation tax applies at 44 percent on the corporation tax payable. 1 If a company has capital in excess of 100 million Japanese yen or is a wholly owned subsidiary of a large corporation with capital of more than 500 million Japanese yen the company is treated as large corporation under corporate tax. The 2017 rules also require that any of these kinds of foreign companies are subject to a corporate tax rate that is less than 30 percent of the Japanese corporate tax rate.

The local standard corporate tax rate in Japan is 234 and it applies to normal companies with a share capital which exceeds JPY 100 million USD 896387. But if the company is Medium and small sized company the taxable income limitation does not apply. Tax Rate Applicable to fiscal years Corporation tax is payable at 2 beginning between 1 April 2016 and 31 March 2017 Tax rates for companies with stated capital of JPY 100 million or greater are as follows.

Total Thousand toe 1998-2017 Japan red Total Thousand toe 2017. 5 Standard rate 123 percent of the central tax. Last reviewed - 02 March 2022.

The corporation tax is imposed on taxable income of a company at the following tax rates. 50 of taxable income. Business tax comprises of three variables Regular business tax special local corporate tax and size-based business tax.

Tax base Small and medium- sized companies 1 Other than small and medium-sized companies Taxable income up to JPY8 million in a year 19 15 2 234 3 Taxable income in excess of JPY8 million 234 3. Tax rates for fiscal year filers. Total of GDP.

Effective Corporate Tax Rates With Alternative Rates of Inflation in G20 Countries 2012 35 Figure B-3. However under section 15 corporations with fiscal tax years beginning before January 1 2018 and. Under the 2020 Tax Reform Act the currently effective consolidated tax regime would be abolished and replaced with a new regime of group relief group tax relief.

At present Japans corporate tax rate is 3211 percent. The government initially planned to reduce the rate to below 30 percent in fiscal 2017 after cutting it. Tax year beginning between 1 Apr 201731 Mar 2018.

A Look at the Markets. 55 of taxable income. 6 The special local tax is 81 percent of the prefectural enterprise tax for corporations.

Japan Corporate Tax Rate for Dec 2017. Tax notification must also be submitted when a foreign corporation generates income subject to corporate tax in Japan without establishing a branch office ie where 2 of 334 Table 3-5 applies. Japan red Tax on corporate profits Indicator.

The new regime will be effective for tax years beginning on or after 1 April 2022. 2017 Japan Thousand toe. The tax credit for the promotion of income growth and the tax credit for job creation may be taken in the same fiscal year if certain adjustments are made.

Current Japan Corporate Tax Rate. Tax rates for companies with stated capital of JPY 100 million or greater are as follows. 332 Corporate income taxes and tax rates The taxes levied in Japan on income generated by the activities of a corporation include corporate tax.

Tax year beginning between 1 Apr 201631 Mar 2017. Local management is not required. The maximum rate of 147 percent is levied in Tokyo metropolitan.

Annual growth rate 2001-2020 Japan red Total Annual growth rate 2020 Japan red Net national income Indicator. Corporate - Group taxation. For fiscal periods beginning on or after 1 April 2015 until 31 March 2017 an RD tax credit of generally between 8 and 10 of RD expenditure is available up to 25 of corporate taxable.

60 of taxable income. The tax credit rate is calculated according to the following formula. Tax year beginning after 1 Apr 2018.

Japan 2017 Tax Reform Outline Outline which proposes a comprehensive reform to Japan corporate income tax tax incentives directors compensation and similar rules to increase the competitiveness of Japanese business globally. Corporate income tax rate 232 30-34 including local taxes Branch tax rate 232 30-34 including local taxes Capital gains tax rate 232 30-34 including local taxes Residence A company that has its principal or main office in Japan is considered to be resident. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020.

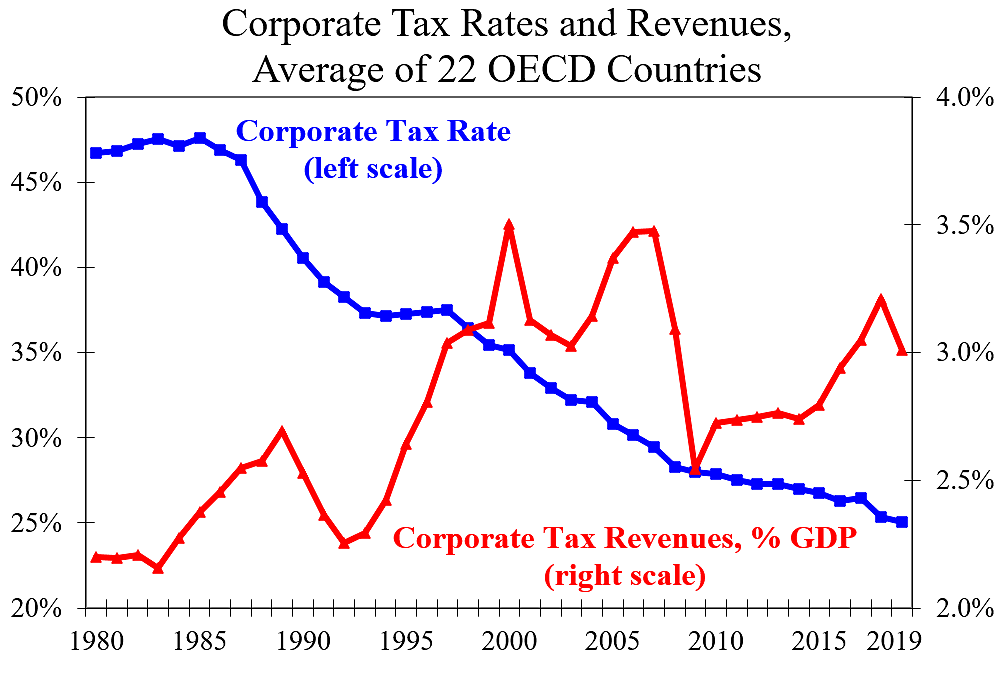

Corporate Taxes Rates Down Revenues Up Cato At Liberty Blog

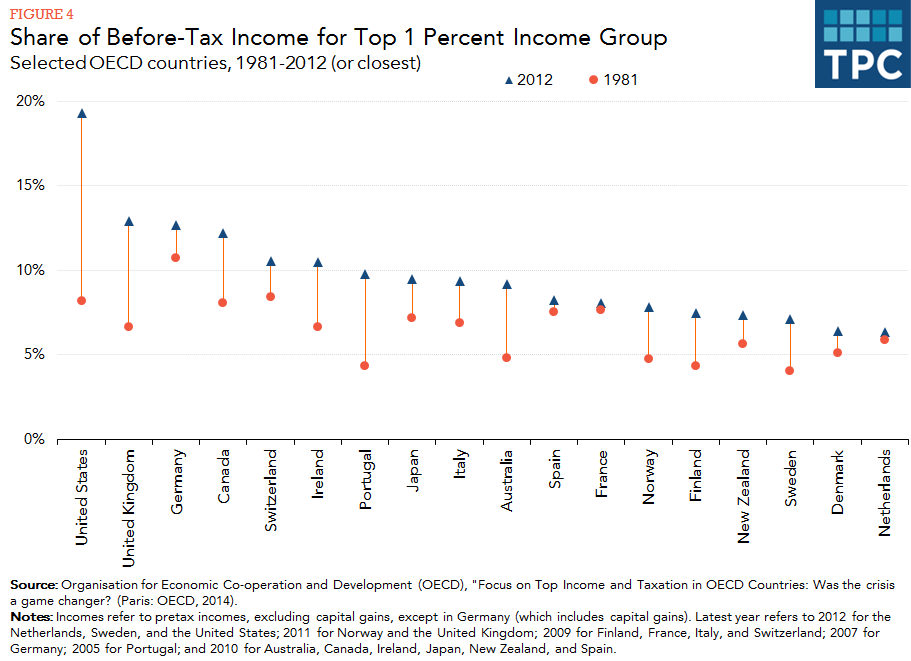

How Do Taxes Affect Income Inequality Tax Policy Center

G7 Backs Global Corporate Tax In First Step Towards Reform Economist Intelligence Unit

Corporate Tax Reform In The Wake Of The Pandemic Itep

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Corporate Income Tax Definition Taxedu Tax Foundation

A Quick Guide To Taxes In Japan Gaijinpot

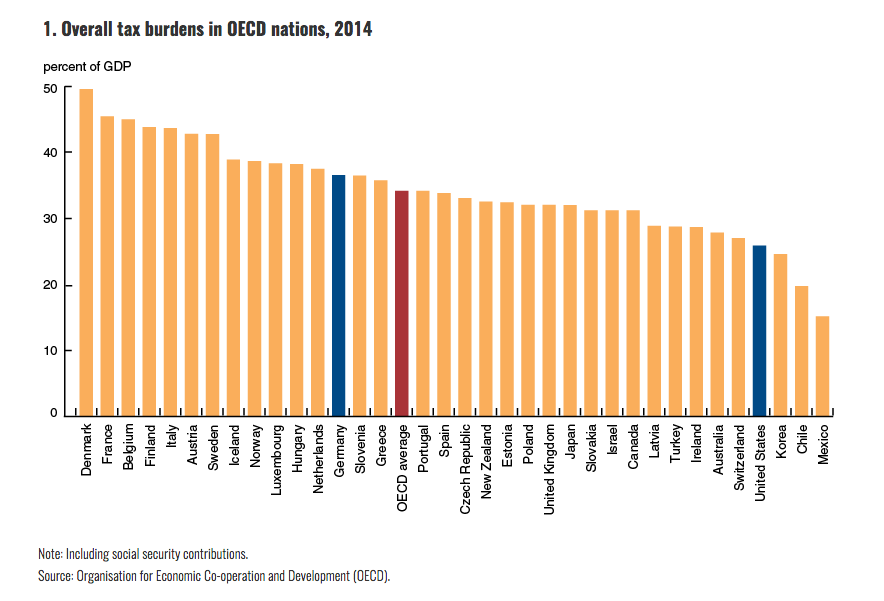

Who Pays More In Taxes U S Vs Europe Developed Countries Money

Japan Real Interest Rate 2022 Data 2023 Forecast 1961 2017 Historical

G7 Backs Global Corporate Tax In First Step Towards Reform Economist Intelligence Unit

Belgium Productivity 2022 Data 2023 Forecast 1995 2021 Historical Chart News

Doing Business In The United States Federal Tax Issues Pwc

Corporate Income Tax Definition Taxedu Tax Foundation

Eritrea Sales Tax Rate Vat 2021 Data 2022 Forecast 2014 2020 Historical

Corporate Tax Reform In The Wake Of The Pandemic Itep

Measuring Tax Support For R D And Innovation Ocde

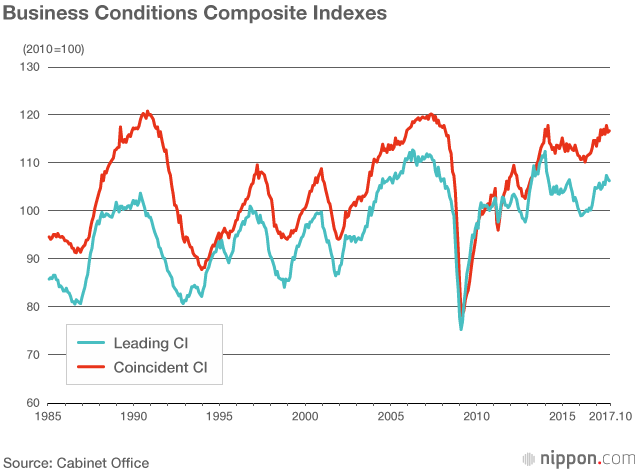

The Japanese Economy In 2018 On Track For A Record Setting Growth Streak Nippon Com